Selling a house capital gains calculator

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

. Add this to your taxable income. For example if you bought a home 10 years ago for 200000 and sold it today for 800000 youd make 600000. Work out your tax rate and multiply by taxable gain The tax rate will be based.

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Its the gain you make thats taxed not the amount of money you receive. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Profits become realized when they. 5 the income range rises slightly to the 41675459750. Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property.

Capital Gains Selling Price Purchase Price 12000 - 10000 2000 Capital gains tax is only paid on realized profits and not on unrealized profits. This tool will help you calculate the Tax amount you have to pay when selling a Property in UK. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

The capital gain is taxed under income tax at the current flat rate of 19 with a linear reduction of 6 from the 6th year and under social security. Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK. Your profit 50000 the difference between the two prices is your capital gain and its subject to the tax.

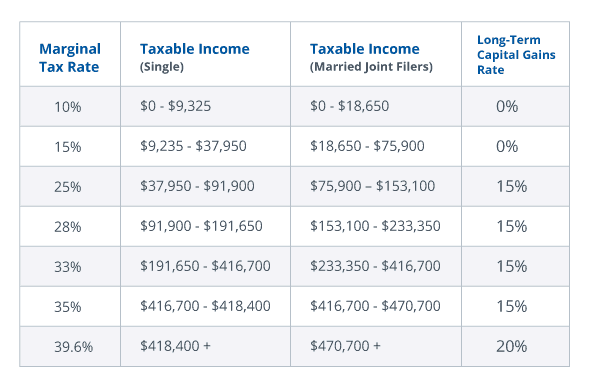

Capital Gains Tax Due Formula Sales Price - Present Value of Total Purchase Price including conveyancing and surveyors fees Present Value of Enhancement Costs Selling Costs. If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021. Capital Gains Tax Exclusion.

Because the combined amount of 20300 is less than 37700 the. Calculating the Capital Gain First things first its called a capital gains tax because the tax is levied on the gain or profit you make when you sell the house rather than the. Infotaxtoolcouk Sponsors Visit our sponsors they help us host this tool Calculator Selling.

On the sale or transfer for valuable consideration of a property located in France. A capital gain represents a profit on the sale of an asset which is taxable. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital.

Or on the sale or transfer for. When you sell your. You are a non-resident and realise a capital gain directly or indirectly.

Simply enter your total earnings. For this tool to work you first need to state. You only pay the capital gains tax after you sell an asset.

500000 of capital gains on real estate if youre married and filing jointly. Taxable gain Total gain MINUS total deductions In our example this would be 87000 - 12300 74700 Step 4. Capital gains and losses are taxed differently from income like wages.

The IRS allows taxpayers to exclude certain capital gains when selling. Tax rate on capital gains.

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gain Formula Calculator Examples With Excel Template

How To Save Capital Gain Tax On Sale Of Residential Property

Free Investment Property Calculator Excel Spreadsheet Investment Property Spreadsheet Template Excel Spreadsheets

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

Cleartax 39 S Guide To Tax Implications On Capital Gains From Sale Of Shares House Property Filing Taxes Tax Refund Income Tax Return

How To Calculate Capital Gains On Sale Of Gifted Property Examples

If I Sell My House Do I Pay Capital Gains Taxes Edina Realty

12 Tax Tips For When You Sell Your Home Taxact Blog

What Loan Down Payment Do You Need A First Time Borrower S Guide No Calculator Required Capital Gains Tax Capital Gain What Is Capital

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message T Selling House Tax Deductions Selling Your

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

Advisor Answers Is There A Way To Minimize Capital Gains Tax When Selling A House If I Plan To Use The Profits To Start Post Lights Roof Installation Roofing

How To Calculate Capital Gains On Sale Of Gifted Property Examples

San Diego Capital Gains Tax On Rental Property In 2022 Mortgage Loans Rental Property San Diego Real Estate

Home Seller Net Proceeds Calculator Calculate Your Net Closing Costs On Real Estate Sales In 2022 Real Estate Sales Closing Costs 30 Year Mortgage